Florida Adjuster Career Options as a Public Adjuster

August 2, 2022

One of the most common questions we get at WeTrainAdjusters is about the difference between an All -lines adjuster holding a 6-20 license and a Public Adjuster (PA) holding the 3-20 license.

The short answer is that the All-lines adjuster is paid directly, or indirectly, by an insurance company. The public adjuster is paid by the insured. Their compensation is based on the settlement the insured ultimately receives for their claim.

But what does this really mean when you are deciding which type of adjuster is a good fit?

First, the good news.

The steps to becoming a licensed PA is very straight forward. While there used to be a separate license for Apprentice Public Adjusters (3-21), it was discontinued a few years ago by the State of Florida. Now, everyone starts out with the same license—the 6-20. Once you get your 6-20 license, you to start work immediately as an All-lines adjuster.

Alternatively, you can work with a licensed PA. The choice is yours and there’s no difference in the process of getting your 6-20.

Now, the less-than-good news.

If you want to be a fully licensed PA, the final step in the process is to take a second exam. After holding your 6-20 for six months, you are eligible to take the 3-20 exam. Only the State of Florida offers this exam, and it is fully proctored and offered through their training centers. You need a 70% or better to pass their exam and you only get one attempt per registration. Once you pass the State exam, you will surrender your 6-20 license and the State will issue you your 3-20 Public Adjuster license. The reason for this, is you are not allowed to, simultaneously, hold two licenses.

So, that’s the process to getting licensed as a PA, but the other thing to consider is how the two jobs differ on a day-to-day basis.

As an All-lines adjuster, you can work for the insurance company as an employee. You can also work as an Independent Adjuster (IA) handling daily claims or Catastrophe (CAT) claims. Either way, once you get hired, the insurance company will send you the claims to adjust. If you are working as an IA, you will be paid based on the value of each claim adjusted.

Public Adjusters need to generate their own clients. Conceptually, it’s similar to a Real Estate agent—the PA is talking to potential clients, trying to show the value of getting help with the settlement. This can involve advertising, social media campaigns, and word of mouth. Unlike the IA, the PA needs to find and retain their own customers.

You can learn more about being a licensed public adjuster at https://www.fapia.net/faq.html

Regardless of which type of adjuster you are considering, WeTrainAdjusters can help.

Our Florida Licensing and Designation course will get you the 6-20 without having to take the Florida State exam. In addition, our Public Adjuster training package will get you licensed and help you prepare to work for a licensed PA.

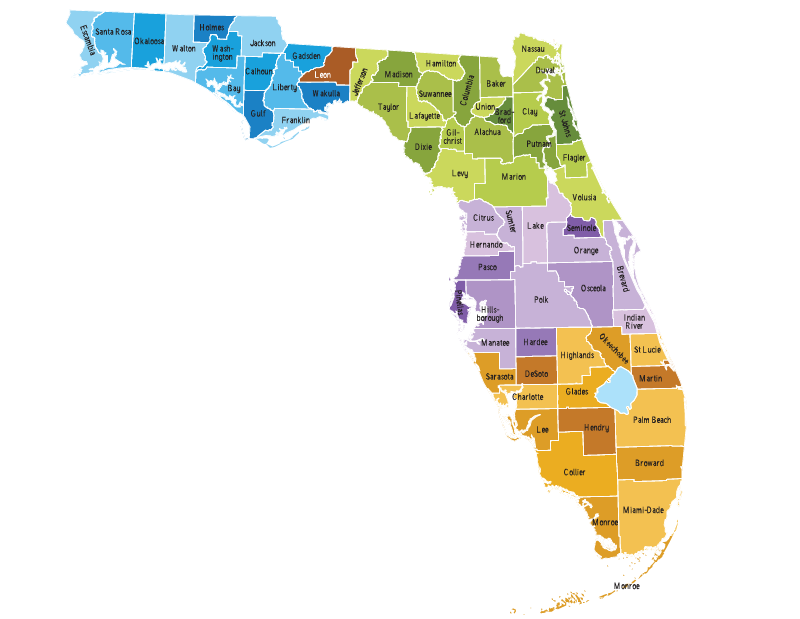

Contact us to discuss the choices. Since the only state WeTrainAdjusters works in is Florida, we are completely focused on helping you make the right decision about which kind of Florida adjuster you want to become.

Don’t wait—adjusting of both types can be an exciting, fulfilling career. Let us help you make the best decision!

Get your Florida All Lines Adjuster License!

Only $288

MyFlorida Agents and Adjusters

For the most current information, visit the Florida Licensing FAQsFlorida Licensing FAQs and look for the Public Adjuster section.

Cards - 2 columns

Content

Cards - 2 columns

Content

Info Badge Danger Badge